May 27, 2020 - Vancouver, BC, Canada - Pacific Empire Minerals Corp. (TSXV: PEMC) (OTCQB: PEMSF) (“Pacific Empire”, “PEMC” or the “Company”), a hybrid prospect generator, is pleased to announce it has entered into an option agreement to acquire a 100% interest in the Jean Marie Project, a copper-gold-silver-molybdenum porphyry project located 50 km west of Centerra Gold Inc.’s Mt. Milligan copper-gold mine in central British Columbia. The Jean Marie Project covers 6,300 hectares and has multiple mineralized zones which are open for expansion.

Highlights:

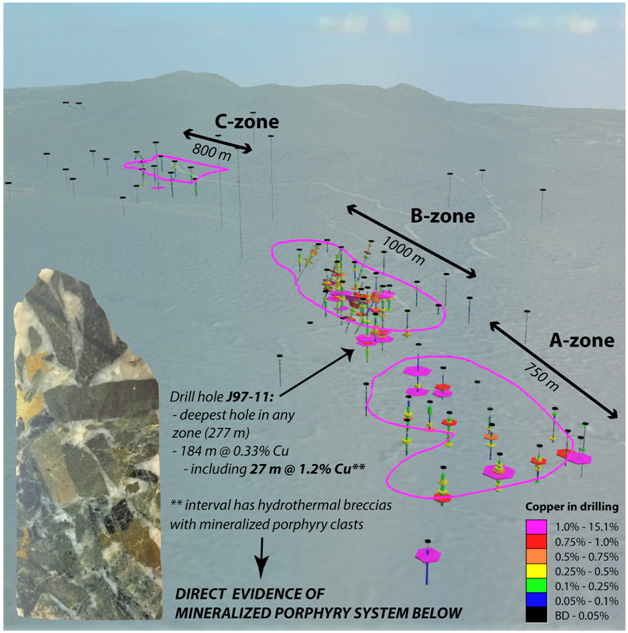

- Historical drilling highlights include drill hole J97-11 which intercepted 184 m @ 0.33% Cu, including 27 m @ 1.2% Cu.

- Three discrete zones, each with indicators showing higher grade potential.

- 9 kilometre trend of highly anomalous copper geochemistry.

About the Jean Marie Project

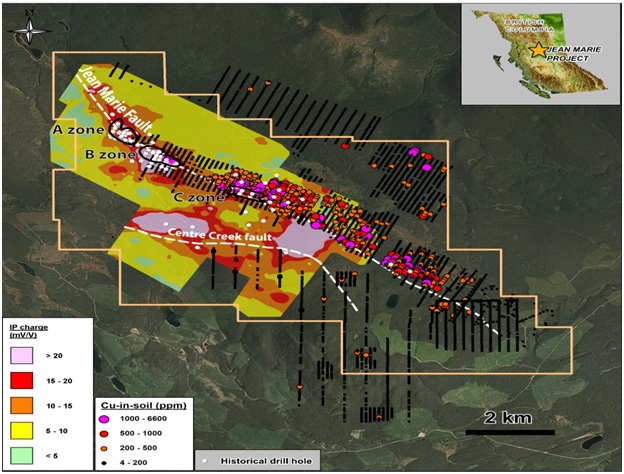

Historical work conducted on the Jean Marie Project includes over 10,000 metres of drilling and dozens of ground-based geophysical and geochemical surveys, with the majority of exploration being completed by Cominco Ltd. between 1970 and 1974. Historical exploration activities were focused on drilling in three copper porphyry zones: the A, B and C Zones (Figure 1). Each of the three mineralized zones straddle the Jean Marie fault, a significant controlling structure that has been mapped for over 12 km on the Project (Figure 2).

Brad Peters, Pacific Empire’s President and CEO, states, “The Jean Marie is an outstanding exploration opportunity for the Company. The presence of several mineralized zones and exploration targets along and adjacent to the Jean Marie fault is highly encouraging and suggests there is a mineralized system of significant size on the Property.”

Figure 1 - Looking SE at Jean Marie historical zones.

The A and C Zones have seen limited historical drilling, with the deepest drilling in both zones being 92 vertical metres. Mineralization in these zones exists as chalcopyrite dominated by pyrite, with rare covellite and bornite. In select surface samples at both the A and C zones, anomalous gold has been seen to be associated with chalcopyrite mineralization and monzonite dikes, though the historical drill core was not systematically assayed for gold. Historical exploration encountered angular float on the southwest margin of the A zone assaying up to 4.43% copper and 0.95 g/t gold.

The A Zone is open to depth and to the north and northwest. The most northwesterly hole in the zone, percussion hole P74-27 graded 0.3% copper over the entire 76.2 metre length of bedrock drilled, including 27.4 metres grading 0.53% copper.

The B Zone has seen more extensive drilling, with the deepest historical drilling being a 277 m vertical drill hole, J97-11. A high-grade interval in this hole occurs between 181 and 208 metres, where a hydrothermal breccia containing angular clasts of porphyritic material with bornite and chalcopyrite graded 1.2% copper over 27 metres. The presence of this breccia provides direct evidence of a mineralized porphyry system at depth beneath the B-zone.

The C Zone is characterized as a broad area of low-grade copper-molybdenum mineralization, with the easternmost hole in the zone grading 0.17% copper over the entire 85.3 metre length of bedrock drilled. However, the presence of a large, strong copper-in-soil anomaly measuring 2,500 x 600 metres, immediately north and east of the C zone, with soil samples assaying up to 0.66% copper suggests more appreciable copper mineralization may exist at depth. The presence of widespread, locally intense clay alteration further suggests there may be potential for higher copper grades at depth.

The Company believes there is strong potential for two or more copper ± molybdenum ± gold ± silver deposits to exist at depth along the Jean Marie fault based on, amongst other thing, the presence of hydrothermal breccias with well mineralized porphyry clasts, sulphide ratios, the presence of illite and kaolinite alteration overprinting limited potassic alteration and the occurrence of higher copper grades at depth.

Figure 2 - Jean Marie compilation - IP geophysics and soil geochemistry.

Details with respect to the consideration payable for the Jean Marie property acquisition are as follows:

Table 1. Option agreement terms.

| Timing | Cash payments* | Share issuances | Work Commitments |

|---|---|---|---|

| Within 7 days of the Effective Date | 100,000 | ||

| Within 45 days of the Effective Date | $15,000 | ||

| First anniversary of the Effective Date | $20,000 | 150,000 | $50,000 |

| Second anniversary of the Effective Date | $40,000 | 200,000 | $250,000 |

| Third anniversary of the Effective Date | $100,000 | 250,000 | $500,000 |

| Fourth anniversary of the Effective Date | $150,000 | 300,000 | $800,000 |

| Fifth anniversary of the Effective Date | $350,000 | 500,000 | $1,100,000 |

| TOTAL = | $675,000 | 1,500,000 | $2,700,000 |

* All dollar amounts expressed in Canadian dollars

The vendors of the property will be granted a 2.5% net smelter royalty (the “NSR Royalty”), one half (1.25%) of which can be purchased at any time for $1,500,000. A further 0.25% of the NSR Royalty can be purchased at any time for $1,000,000, thereby reducing the NSR Royalty to 1.0%.

The transactions contemplated by the option agreement remain subject to approval of the TSX Venture Exchange. Any securities issued as consideration under the option agreement will be subject to a statutory hold period of four months and one day from the date of issuance.

Qualified Person

Rory Ritchie, P.Geo., Vice President of Exploration for the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has approved the scientific and technical information and disclosure contained in this news release.

About Pacific Empire Minerals Corp.

PEMC is an exploration company based in Vancouver, British Columbia, that employs a "hybrid prospect generator" business model and trades on the TSX Venture Exchange under the symbol PEMC and on the OTCQB Markets under the symbol PEMSF.

By integrating the project generator business model with low-cost reverse circulation drilling, the company intends to leverage its portfolio by identifying, and focusing on, the highest quality projects for partnerships and advancement.

ON BEHALF OF THE BOARD,

“Brad Peters”

President and Chief Executive Officer

Pacific Empire Minerals Corp.

Tel: +1-604-356-6246

brad@pemcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. All statements, other than statements of historical fact, included herein including, without limitation, are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of our common share price and volume and the additional risks identified the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.