NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES

NOR FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

January 3, 2024 - Vancouver, BC, Canada - Pacific Empire Minerals Corp. (TSXV: PEMC) (“Pacific Empire”, “PEMC” or the “Company”), a British Columbia copper-gold explorer, announces that it has closed the first tranche of the non-brokered private placement (the “Offering”) announced on December 19, 2023. Under the first tranche of the Offering, the Company issued 9,000,000 common shares (the “Shares”) at a price of $0.01 per Share, and 10,999,999 “Flow-through” shares (the “FT Shares”) at a price of $0.015 per FT Share, for aggregate gross proceeds of approximately $255,000.

The proceeds of the FT Shares portion of the first tranche of the Offering will be used for the exploration of the Company’s Trident project, and the proceeds of the Shares portion of the first tranche of the Offering will be used for general corporate purposes and exploration of the Company’s properties.

In connection with the Private Placement, the Corporation has agreed to pay to Haywood Securities Inc. (the “Finder”) a commission of 7% of the gross proceeds raised from the FT Shares sold to the purchasers by such Finder (the “Finder’s Fee”) payable in cash and issue to the Finders the number of Common Share purchase warrants (the “Broker Warrants”) that equals 7% of the aggregate number of FT Shares placed by each of the Finder. Each Broker Warrant will entitle the Finder to purchase one Common Share Common Share at an exercise price of $0.02 for a period of 12 months from closing and at a price of $0.10 for the period from December 29, 2024 to December 29, 2026.

All securities issued in connection with the first tranche of the Offering (being the Shares, the FT Shares, and the Finder’s Warrants, are subject to a statutory hold period expiring April 30, 2024.

Certain officers and directors of the Company participated in the Offering, purchasing in the aggregate 1,333,333 FT Shares for aggregate proceeds of $20,000, which constitutes a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61101”). Such participation is exempt from the valuation and minority approval requirements of MI 61-101 by virtue of the fact that the Company is not listed on a specified market set out in section 5.5(b) of MI 61-101 and the value of FT Shares subscribed for by such officers and directors is less than $2,500,000 in accordance with the requirements of section 5.7(b) of MI 61-101.

About Trident

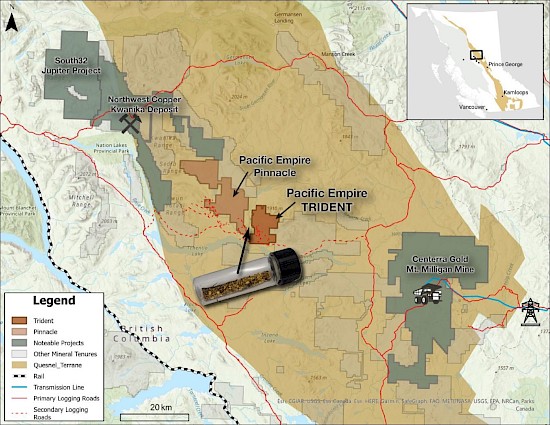

The Trident property is an exploration stage alkalic porphyry copper-gold-silver prospect with district-scale potential that is accessible by vehicle. The property is located approximately 50 km to the southeast of Northwest Copper Corp.’s Kwanika Deposit and 50 km to the northwest of Centrerra Gold’s Mt. Milligan Mine. The property covers 6,618 hectares and is accessible by vehicle using well established logging roads.

Copper mineralization on the property was first discovered in 1969, while following up on anomalous stream sediment samples. The following year Falconbridge optioned the property and over the next two years completed IP and magnetic surveys, geological mapping, soil sampling and diamond drilling. This work identified the A Zone.

Additional exploration programs were completed by Kookaburra Gold Corp. from 1988 through 1991, Solomon Resources Ltd., from 2006 through 2008. In 2013 PEMC optioned the property. The following year PEMC optioned the property to Oz Minerals. In 2014 Oz completed a significant IP survey and two diamond drill holes at Trident.

In 2022, Pacific Empire acquired a 100% interest in the property in exchange for granting the vendors a 2% net smelter return royalty ("NSR"). One-half (1%) of the 2% NSR may be purchased for $500,000 by Pacific Empire.

Prior to 2014, mineralization on the property was believed to be associated with fracture and/or shear zones that strike 120 degrees and dip 75 degrees to the northeast. Review of historical drill core by Pacific Empire has led to a much different interpretation with respect to the nature of mineralization on the property. The most important observation was the presence of hornblende-feldspar monzonite porphyry intrusions in drill core from the A Zone. These porphyry intrusions are characterized by sheeted quartz sulphide veins and disseminated chalcopyrite and bornite immediately adjacent to and within the porphyry dikes. The highest grades in historical drilling are directly associated with intervals where such porphyry intrusions occur.

South Hogem Copper-Gold Belt

“The gold in the vial in the above image came from the river that divides Trident and Pinnacle projects. It was collected by PEMC by panning over the course of a number of days. I am not sure if it came from Trident or Pinnacle or ideally both,” commented Brad Peters, President and CEO of Pacific Empire. “It does suggest though that there is certainly the potential in this area for a significant gold-enriched copper deposit. At a conference when I was young I was told that if I ever find visible gold on a copper property, keep looking. So far I have encountered visible gold at Trident in outcrop, in the river and at Pinnacle in drill core.”

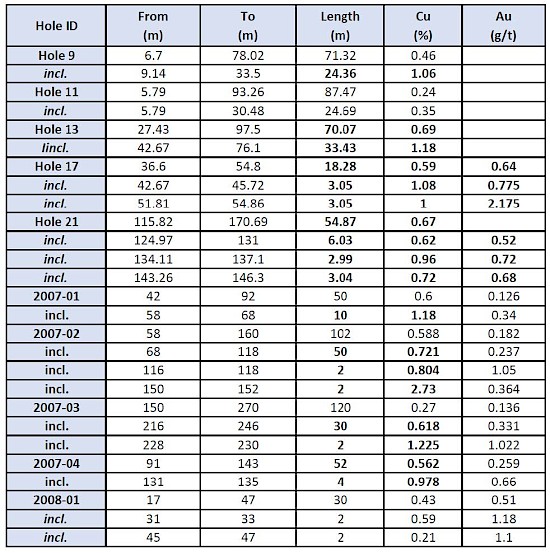

Highlights from Historical Drilling at Trident

About Pinnacle

The Pinnacle project is located 60 km to the west of Centerra Gold's Mt. Milligan Copper-Gold Mine and 30 km to the southeast of NorthWest Copper’s Kwanika Copper-Gold Deposit in a proven copper-gold porphyry district. Access to the Pinnacle is by road including a new and expanding network of logging roads and trails throughout the main target areas. This improved access is a major development and is anticipated to contribute to cost effective drill support and bedrock exposure.

“We are truly excited to have Pinnacle back as it is fully permitted for diamond drilling, in addition work by Teako advanced our understanding of the Aplite Ridge target area. Over the past 2 years significant logging operations have developed a road network that now covers the entirety of the southern half of the property. The 2023 forest fires dramatically affected the property, further opening it up.“ commented Brad Peters, President and CEO of Pacific Empire.

Qualified Person

Kristian Whitehead, P.Geo., serves as a qualified person as defined by NI 43-101 and has reviewed the scientific and technical information in this news release, approving the disclosure herein.

About Pacific Empire

Pacific Empire is a copper exploration company based in Vancouver, British Columbia and trades on the TSX Venture Exchange under the symbol PEMC. The Company has a district scale land position in north-central British Columbia totaling 22,541 hectares.

British Columbia is a “Green” copper jurisdiction with abundant hydroelectric power, access and infrastructure in close proximity to the end market.

ON BEHALF OF THE BOARD,

“Brad Peters”

President and Chief Executive Officer

Pacific Empire Minerals Corp.

Tel: +1-604-356-6246

brad@pemcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. All statements, other than statements of historical fact, included herein including, without limitation: closing of the Offering is expected to occur on or around December 31, 2023, the funds will be used for exploration on its flagship Trident copper-gold-silver project and for general working purposes, are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of our common share price and volume and the additional risks identified the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.